ROI Calculator

Calculate your return on investment and visualize your potential profits.

ROI Calculator: Calculate Profit & Annualized Growth Instantly

Are you unsure if your investments are actually making money? Stop guessing and start knowing. Whether you are tracking stock performance, business expenses, or marketing campaigns, you need clear numbers to make smart decisions.

This free ROI Calculator solves that pain point immediately. It helps you measure your success by showing exactly how much profit you’ve made compared to what you spent. Get accurate financial insights in seconds, not hours.

What Is This ROI Calculator?

This tool is a powerful financial utility designed to measure the efficiency of an investment. It calculates your Return on Investment (ROI)—a simple percentage that tells you if you are making a profit or a loss.

Unlike basic calculators, this tool also calculates Annualized ROI, helping you understand how your investment performs over time (like strictly per year), rather than just the total result.

3 Major problems this tool solves:

- Confusing Math: It automates the ROI formula, eliminating errors from manual calculations.

- Time Context: It accounts for the “Time Period,” showing you if a profit took 1 year or 10 years to achieve.

- Visual Clarity: It generates a bar chart (Initial Investment vs. Final Value) so you can visualize your growth instantly.

How to Use This Tool

We designed this interface to be “dummy-proof.” Follow these steps to get your ROI percentage right now:

- Enter Initial Investment: Type in the total amount of money you started with or spent (e.g., the cost of buying stock or ad spend).

- Enter Projected Final Value: Enter the total value of the investment now. (Note: This is the total amount returned, which includes your initial money plus profit.

- Select Time Period: Enter the duration of the investment (e.g., “1” and select “Years”) to get accurate annualized data.

- View Results: Look at the right-hand panel to see your Total ROI, Net Profit, and Annualized ROI.

Privacy Note: Your financial data is processed locally in your browser. We do not store or share your investment details.

Key Features

- Annualized ROI Breakdown: Most tools only show total return. This investment ROI calculator breaks down earnings per year, which is crucial for long-term investors.

- Visual Data Graph: A clear bar chart automatically updates to visually compare your starting cost against your final value.

- Instant “Net Profit” Display: It creates a clear separation between your percentage return and the actual dollar amount you pocketed.

- Flexible Time Units: Whether your investment spans months or years, the tool adjusts the math for you.

- Mobile Optimized: Calculate on the go with a design that works perfectly on smartphones and tablets.

Who Is This Tool For?

This ROI calculation tool is essential for anyone dealing with money:

- Investors & Traders: Quickly check the performance of stocks, crypto, or real estate assets over specific timeframes.

- Business Owners: Analyze if a purchase (like new machinery) is paying off by comparing the cost against the value it generates.

- Digital Marketers: Use it as a marketing ROI calculator to see if your ad campaigns are generating enough revenue to justify the budget.

- Students: A perfect companion for double-checking answers on finance and business homework.

Why Use Our Tool?

Why choose this specific online ROI calculator over others?

- Accuracy: We use standard financial formulas to ensure your ROI metrics are precise.

- Speed: No sign-ups or loading screens. You get your numbers immediately.

- Cost: It is 100% free. Professional-grade analytics without the subscription fee.

- Ease of Use: The clean interface means you don’t need a finance degree to understand your profits.

Example: How It Works

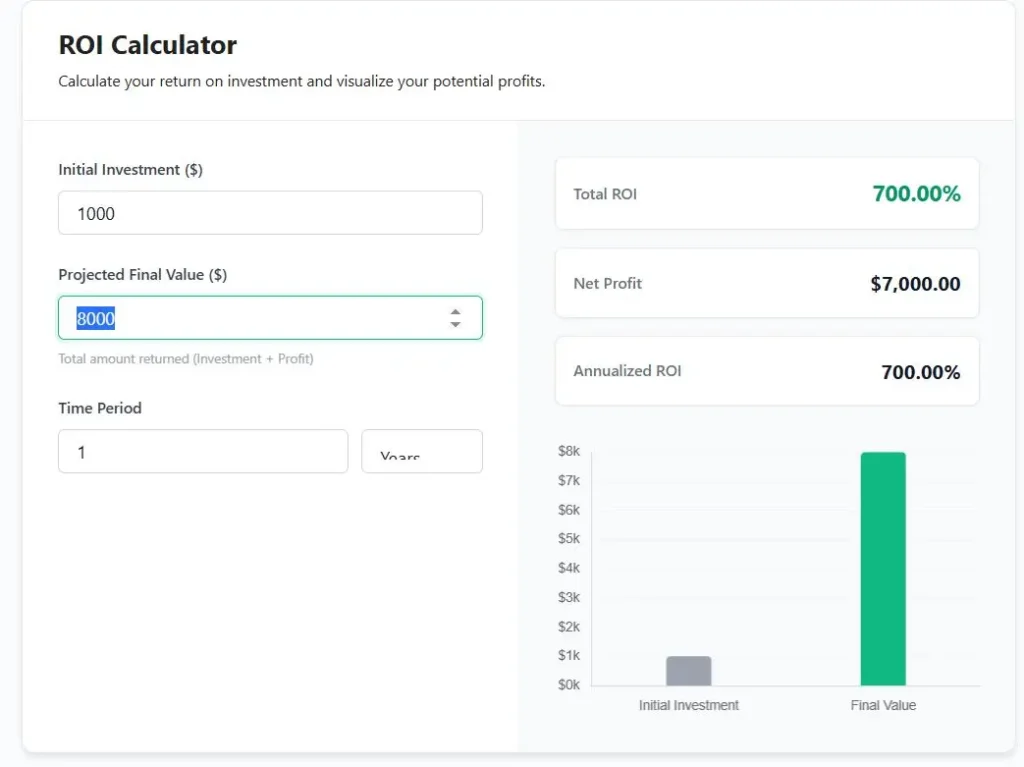

To demonstrate the effectiveness of this tool, let’s examine a realistic scenario for a small business investment.

Scenario: You invest $1,000 into a new product line. After 1 year, the total revenue generated (final value) is $8,000.

| Input Field | Value Entered |

| Initial Investment | $1,000 |

| Projected Final Value | $8,000 |

| Time Period | 1 Year |

| OUTPUT | RESULT |

| Net Profit | $7,000 |

| Total ROI | 700.00% |

In this example, the tool instantly calculates a 700% return, confirming this was a highly successful investment.

Frequently Asked Questions

What is the ROI formula?

The basic formula is: (Net Profit / Cost of Investment) x 100. Net Profit is calculated by subtracting your Initial Investment from the Final Value.

What is the difference between Total ROI and Annualized ROI?

Total ROI is the total percentage earned over the entire life of the investment. Annualized ROI calculates what that return would look like if it were averaged out per year.

Can I use this for real estate?

Yes. Enter your down payment and renovation costs as the “Initial Investment” and the property’s current market value as the “Projected Final Value.”

What if my ROI is negative?

If your Final Value is lower than your Initial Investment, the ROI estimator will show a negative percentage. This indicates a financial loss.

Is this a profit investment calculator?

Yes. By showing “Net Profit” separately, it functions as a profit calculator, letting you see exactly how much cash you gained on top of getting your money back.

Conclusion:

Understanding your numbers is the first step to wealth. Our ROI Calculator simplifies financial analysis, providing clear, data-driven insights instantly. Whether for business, school, or personal investing, accurate data is now at your fingertips.